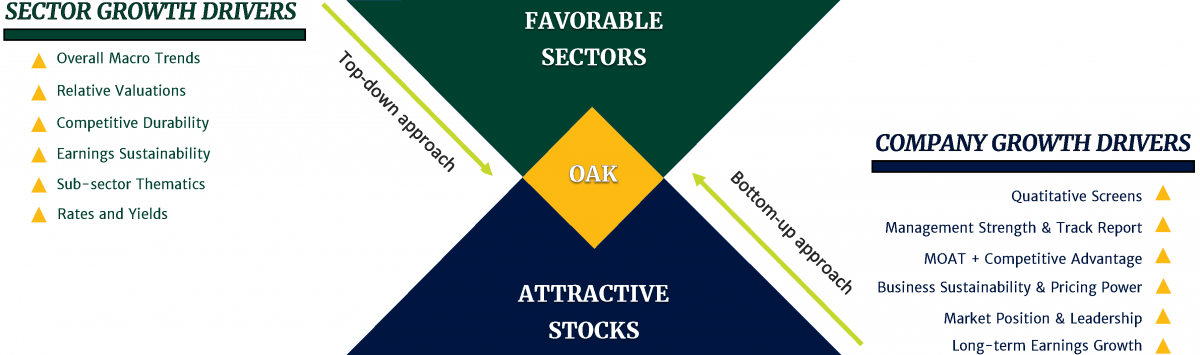

At Oak, we believe that sustainable long-term growth for investors is best achieved through a concentrated focus on companies and sectors. Our high-conviction stock selection process centers on identifying multiple drivers of growth and engaging in fundamental research to uncover the right businesses within the right sectors. We then take meaningful positions—targeting unrealized value and seeking long-term capital appreciation independent of typical index results.

Dual-Concentrated Investment Approach

P

Long-term fundamental and multi-cycle analysis to uncover the highest conviction sectors and holdings fueled by multiple drivers of growth

O

O

Our Top-Down approach identifies Favorable Sectors in which to invest, while our Bottom-Up approach finds Attractive Stocks within those Favorable Sectors.

Oak's commitment

We are committed to being better investors today than we were yesterday. A key to good investing is not making the same mistakes over and over. We remain humble, continuously focused on improving our craft, and thankful for the opportunity to manage your money.

Oak Associates employees and their families maintain significant investments in the same stocks held in clients' portfolios; our interests are aligned with those of our clients.

Our firm culture supports doing what’s best for investors: In an industry where portfolio managers may be pressured to achieve short-term results, Oak portfolio managers have the latitude to make decisions which maximize long-term returns. Superior long-term results inevitably come from patient, disciplined, and at times, unpopular, decisions.